Introduction

In today’s interconnected world, international money transfers are a crucial part of global finance. Whether individuals send money to support family members, businesses pay for services, or investors manage their international portfolios, the ability to transfer money across borders is essential. For example, many people rely on services to transfer money to Europe, which highlights the practical importance of understanding these processes. However, various countries impose limits on money transfers from abroad, adding a layer of complexity to these transactions.

Regulatory Framework

The regulations governing international money transfers vary widely across different countries. These rules are designed to ensure the legality and traceability of funds moving across borders. Understanding the required documents for increasing limits can help individuals and businesses navigate these regulations more effectively. Compliance with these regulations is crucial to avoid legal issues and penalties.

Reasons for Imposing Limits

Governments impose limits on money transfers from abroad for several reasons:

- Preventing Money Laundering and Terrorist Financing: Regulations are often in place to prevent illegal activities. By limiting the amount of money that can be transferred, authorities can better monitor suspicious transactions.

- Protecting the Domestic Economy: Caps on money transfers help protect the domestic economy from potential adverse effects, such as excessive capital outflows that can destabilize financial markets.

- Ensuring Tax Compliance: Limits also help ensure that individuals and businesses pay appropriate taxes on international income, thereby increasing government revenue and maintaining economic stability.

Impacts on Individuals and Businesses

Limits on money transfers can significantly impact both individuals and businesses:

- Individuals: Expatriates sending money to support their families often face challenges due to these limits. Restrictions can delay payments, increase costs, and create financial uncertainty for recipients.

- Small Businesses and Startups: For small businesses engaged in international trade, transfer limits can hinder operations, restrict growth, and complicate financial planning.

- International Trade and Investment: Transfer limits can affect the flow of international trade and investment by creating barriers to financial transactions, thereby impacting global economic integration.

Navigating Transfer Limits

To effectively manage and navigate transfer limits, individuals and businesses can employ several strategies:

- Staying Within Legal Limits: Understanding and adhering to the transfer limits imposed by regulatory authorities is essential. This can involve structuring transactions to stay within allowable limits.

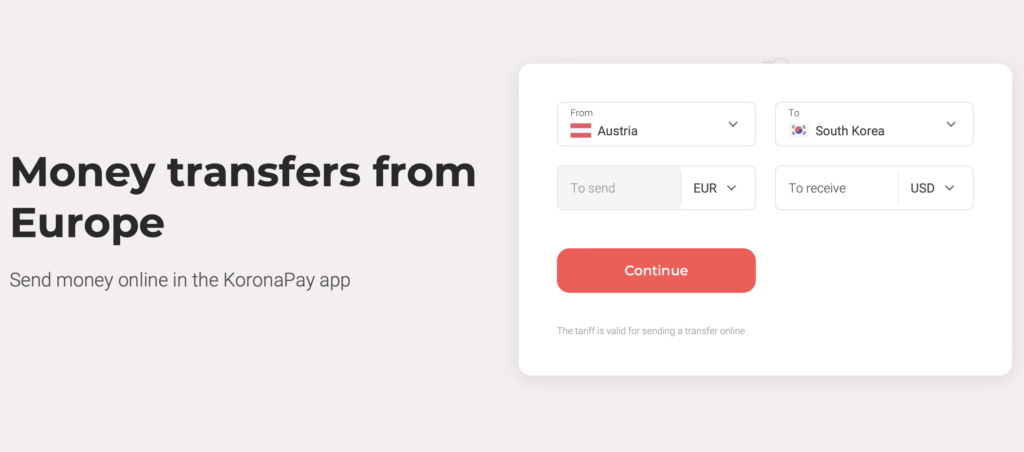

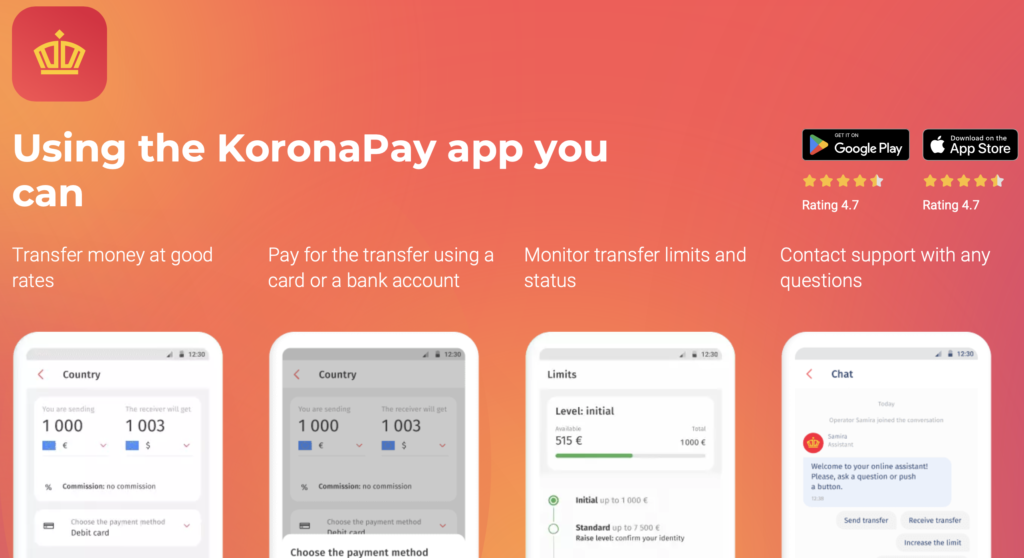

- Alternative Methods for Transferring Money: Utilizing various money transfer services, cryptocurrencies, and other financial instruments can provide alternative ways to move money across borders.

- Minimizing Fees and Maximizing Efficiency: Comparing different money transfer services and their fees can help find the most cost-effective and efficient options for international transactions.

Case Studies

Several real-world examples illustrate the impact of transfer limits and the strategies used to overcome these challenges:

- Individual Case: A family member working abroad uses multiple money transfer services to send smaller amounts within legal limits, ensuring financial support reaches their family without breaching regulations.

- Business Case: A small business leverages digital financial tools and partnerships with international banks to manage cross-border transactions efficiently, navigating transfer limits while maintaining smooth operations.

Future Trends

The landscape of international money transfers is continually evolving:

- Potential Changes in Regulations: Governments may update regulations to adapt to the changing financial environment, potentially easing or tightening transfer limits.

- Role of Technology and Fintech: Advances in technology and fintech innovations are likely to reshape the future of international money transfers. These advancements can provide new tools and platforms to facilitate smoother and more compliant transactions.

Conclusion

Understanding the limits on money transfers from abroad is essential for individuals and businesses engaged in international financial transactions. By staying informed about regulations, exploring alternative methods, and utilizing technological advancements, it is possible to navigate these limits effectively. As the global financial landscape continues to evolve, staying adaptable and informed will be key to managing international money transfers successfully.

Discover more from Life and Tech Shots Magazine

Subscribe to get the latest posts sent to your email.